"In private equity, ESG due diligence isn't a luxury—it's a necessity, essential for mitigating risks, attracting responsible investors, and sustaining growth."

The core challenge in any PE deal is maximizing profitability, making risk mitigation crucial. Thorough and robust due diligence is invaluable, helping investors pinpoint various potential risks, including financial, tax, and IT concerns. Moreover, it is essential to consider ESG risk factors, given the increasing prominence of ESG legislation and directives worldwide. Besides that, a lack of ESG performance improvements is the most dominant reason Limited Partners walk away from investments (Bain & Company, 2022).

In general, General Partners face two main challenges:

- Difficulty quantifying and monitoring ESG Performance

- A lack of harmonized ESG Reporting Standards

Good Growth Collective is your ESG Due Diligence expert that can add immediate value.

Our services

What we do

Discover how we mitigate unnecessary investment risk.

Pre-Deal Solutions

Performing ESG Due Diligence on your target company

Post-Deal Solutions

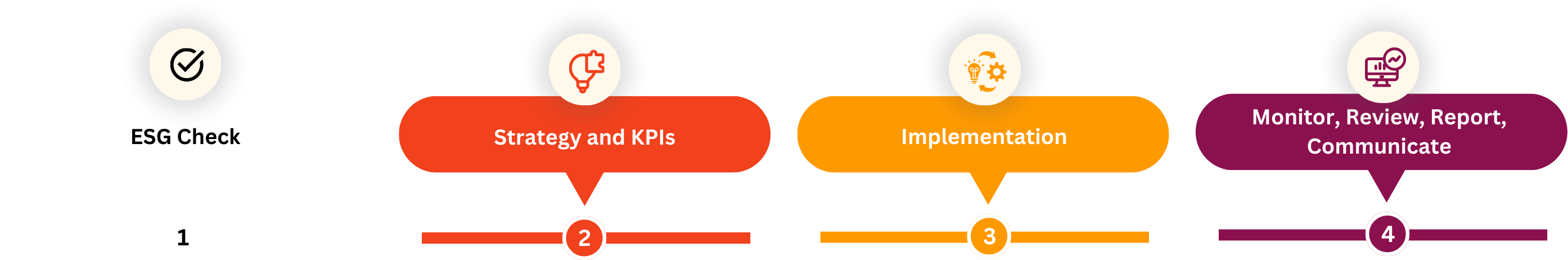

Get an analysis of your portfolio company followed by the implementation and communication process of a tailored ESG strategy

Take your investments to the next level

Working with us future-proofs your investments.

Better financial returns

Unnecessary investment risk mitigation

Alignment with LP demands for responsible investments (SFDR)

Improved regulatory compliance

Room for growth and innovation

Cost-saving opportunities and efficiency improvements

Broader appeal to investors in the increasingly ESG-focused market

Streamlined exit processes to meet buyer and investor expectations

Strengthened brand reputation

Increased stakeholder trust

*in-person meetings take place in our Amsterdam office on Warmoesstraat 149-151